fino.analytics

Adding value to data!

Account and data analysis

Stop collecting Data - Start Using IT!

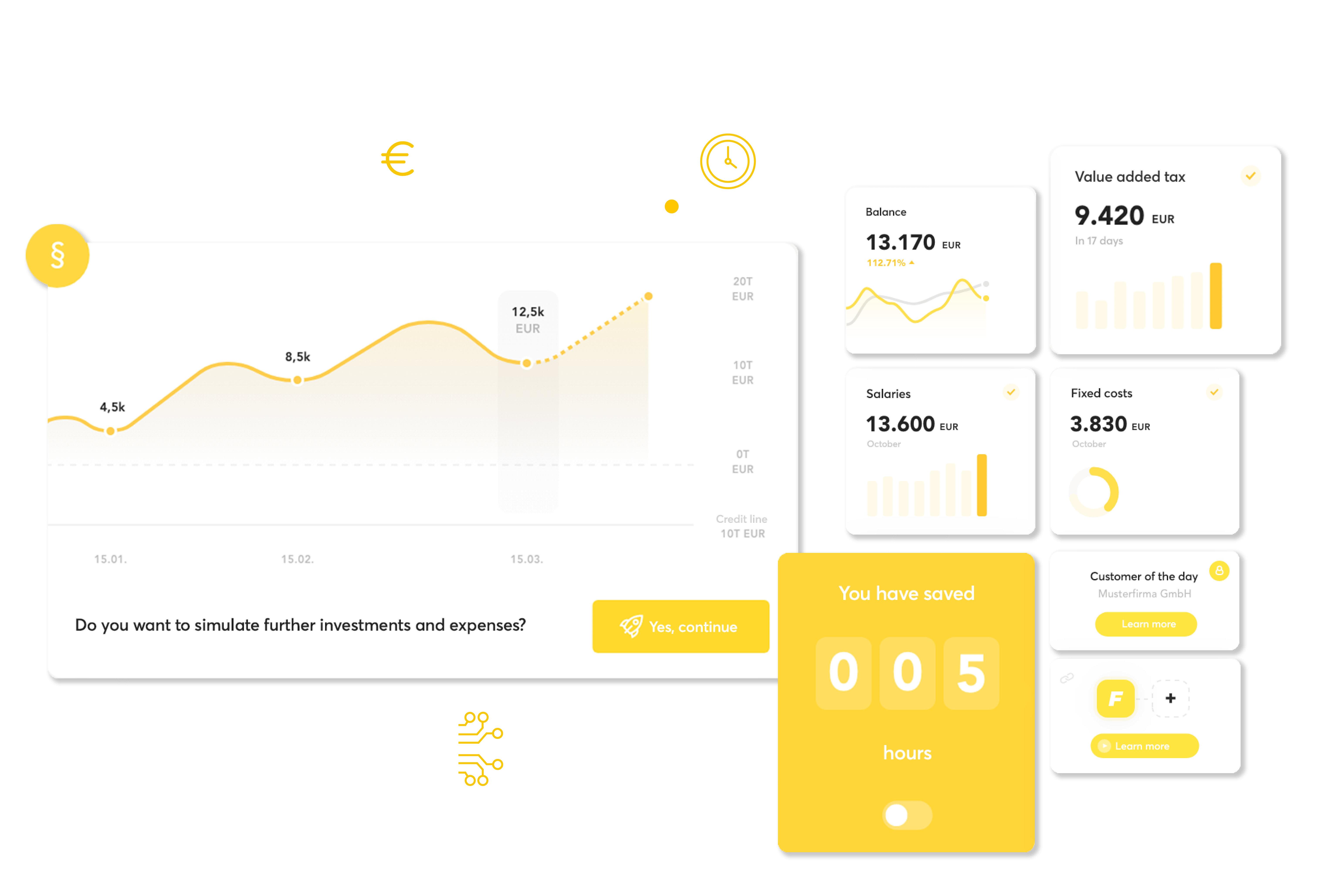

Our AI-based data analytics technologies analyse the account transactions pre-authorised by private or business customers in real time and use them to automatically generate valuable information on financial and life situations, credit and loans, contracts and pension gaps, real estate, liquidity and even recognise life-changing moments, such as retirement or the birth of a child.

Whether sales impulses, credit checks, invoice & transaction matching, risk analysis or improved customer experience for your processes – our fino.analytics products create real added value from data for you and your customers for an almost infinite number of use cases and boost your business model at warp speed!

Open Banking Modules

More than access to account!

At fino.analytics, we have taken access to account a step further: with our Open Banking modules, we combine PSD2-compliant access to account transaction data with pioneering data analytics modules. Depending on the use case and according to the modular principle, the categorisation, contract recognition, payment, LaaS , logo API or preconfigured analysis services modules supplement Access to Account and provide you and your customers with exactly the information you need to advance your project – customised, modular, connecting the dots!

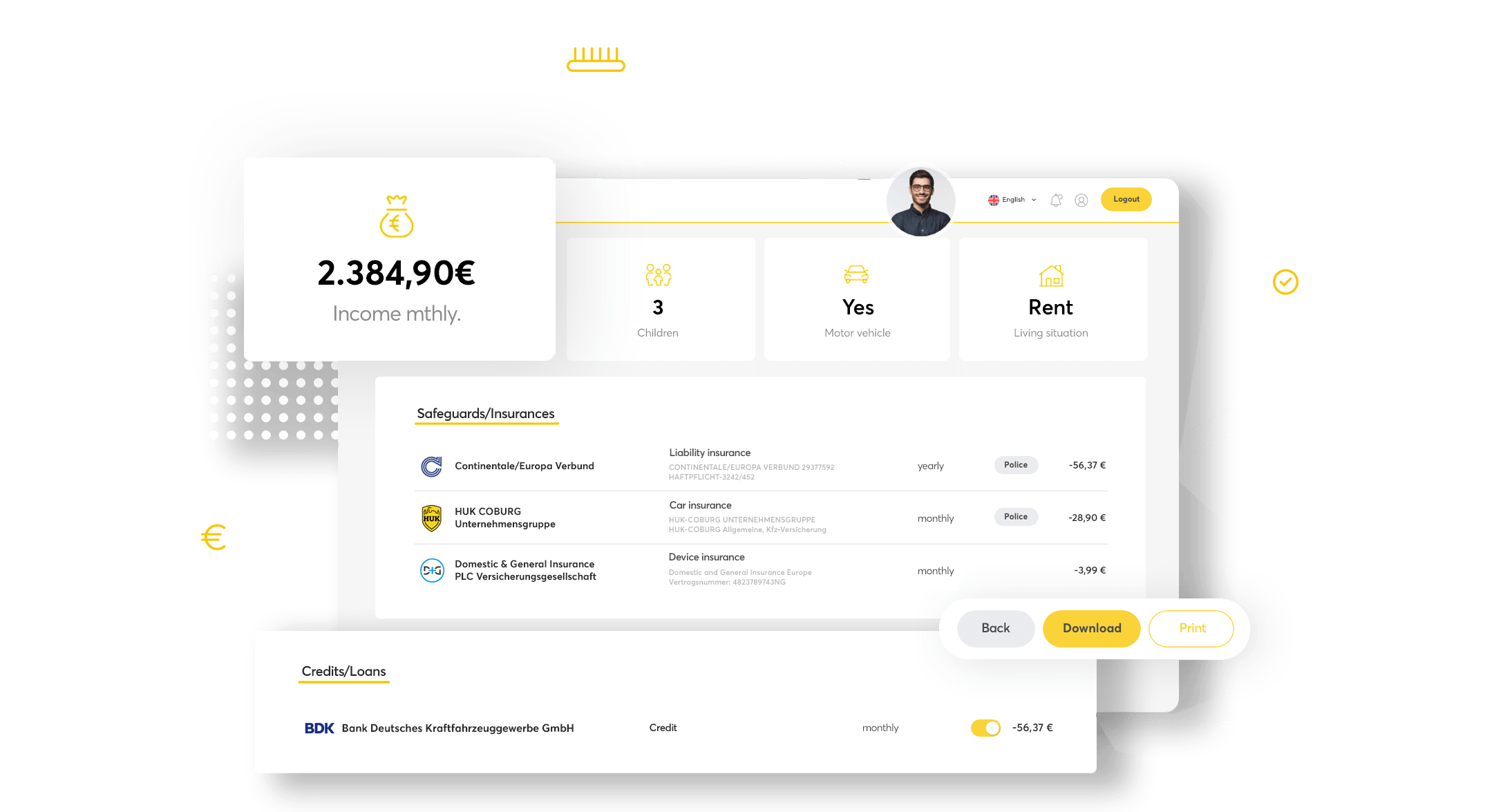

fino-Cockpit

More sales at the touch of a button!

Advising customers correctly from the very first moment? Challenge accepted!

With fino-Cockpit, our smart sales assistant , time-consuming analyses of customer needs and sales potential are a thing of the past. With the help of AI-supported account and data analysis, fino-Cockpit identifies current customer needs in a matter of seconds and prepares valuable insights on income & life situation, loans & credits, contracts, investments and much more for you! This provides you with relevant sales impulses for your consultation and scores points – even with new and business customers – with customised product offers.

Liquidity management

With foresight: Cash Flow & Liquidity

Data analytics to get you started

We are the data experts at your side

PSD2-compliant

fino is certified by Federal Financial Supervisory Authority as account information and payment initiation service provider (AISP/PISP). Our analytics technologies fulfil the strict PSD2 directive and the highest security standards.

AI algorithms

fino.analytics solutions utilise only the most innovative analysis methods for excellent results. We are the unbeaten champion in the industry when it comes to contract recognition and categorisation – turning data into knowledge!

Universal

Data analytics without borders: Our services are universally applicable – whether for business or private accounts in Germany, Europe or overseas! fino.analytics creates added value from data – everywhere for everyone!

Would you like to find out more?

I look forward to advising you!